As the new year approaches, taxpayers are eagerly awaiting the release of the 2025 tax brackets by the Internal Revenue Service (IRS). The IRS has finally released the updated tax brackets for the 2025 tax year, and it's essential to understand how these changes may impact your tax liability. In this article, we'll break down the new tax brackets and provide insights on how to plan your finances accordingly, courtesy of

Franklin Planning.

What are Tax Brackets?

Tax brackets are the ranges of income that are subject to different tax rates. The United States has a progressive tax system, meaning that higher income earners are taxed at a higher rate. The tax brackets are adjusted annually to account for inflation, ensuring that taxpayers are not pushed into a higher tax bracket due to cost-of-living increases.

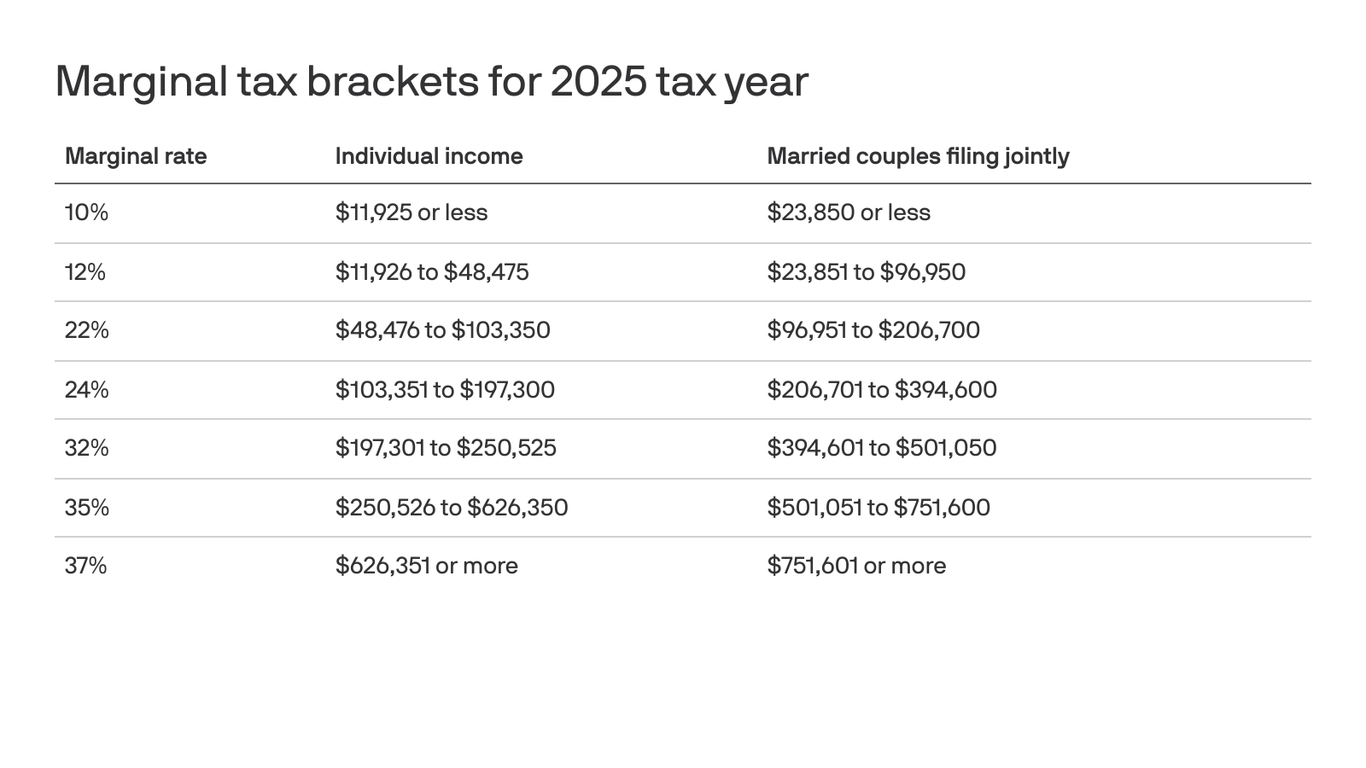

2025 Tax Brackets

The IRS has released the following tax brackets for the 2025 tax year:

10%: $0 - $11,600 (single), $0 - $23,200 (joint)

12%: $11,601 - $47,150 (single), $23,201 - $94,300 (joint)

22%: $47,151 - $100,525 (single), $94,301 - $201,050 (joint)

24%: $100,526 - $191,950 (single), $201,051 - $383,900 (joint)

32%: $191,951 - $243,725 (single), $383,901 - $487,450 (joint)

35%: $243,726 - $609,350 (single), $487,451 - $731,200 (joint)

37%: $609,351 and above (single), $731,201 and above (joint)

How Do the New Tax Brackets Affect You?

The updated tax brackets may impact your tax liability, depending on your income level and filing status. If you're a high-income earner, you may be subject to a higher tax rate. On the other hand, if you're a low-to-moderate income earner, you may see a reduction in your tax liability.

It's essential to consult with a tax professional or financial advisor to understand how the new tax brackets affect your specific situation. They can help you navigate the tax code and provide guidance on tax planning strategies, such as income deferral, charitable donations, and retirement contributions.

Tax Planning Strategies with Franklin Planning

At

Franklin Planning, our team of experts can help you develop a comprehensive tax plan that takes into account the new tax brackets. We'll work with you to:

Optimize your income and deductions

Minimize your tax liability

Maximize your retirement savings

Develop a charitable giving strategy

Don't wait until tax season to plan your finances. Contact

Franklin Planning today to schedule a consultation and ensure you're taking advantage of the new tax brackets.

The 2025 tax brackets have been released, and it's crucial to understand how these changes may impact your tax liability. By working with a tax professional or financial advisor, you can develop a tax plan that takes into account the new tax brackets and minimizes your tax liability. Remember to consult with

Franklin Planning to ensure you're making the most of the new tax brackets and achieving your financial goals.